Governance, Risk and Compliance

A company-wide directive to achieve results that meet internal guidelines and processes.

This is our approach to achieve our objectives, address uncertainty and act with integrity

Governance

Using a combination of information and hierarchical management control structures, we ensure that critical management instructions reach the team timely, accurately and sufficiently complete. The control mechanism that we provide ensures that directions, instructions and strategies are performed systematically and effectively by the respective teams.

Risk Management

Our management identifies, analyses, and, where necessary, responds appropriately to risks that might adversely affect realization of the GivingFridays’ business objectives. Our response to risks typically depends on their perceived gravity, and involves controlling, avoiding, quantifying their impact, accepting or transferring them to a third party.

Compliance

Compliance is achieved through management processes which identify the applicable requirements, assess the state of compliance, risks and potential costs of non-compliance against the projected expenses to achieve compliance, and hence prioritize, fund and initiate any corrective actions deemed necessary.

Safety and security are assured with our international PCI-DSS compliant payment gateway.

Know Your Customer (KYC)

We, through the payment gateway, perform KYC (Know Your Customer) to assess your business and confirm that we are engaging with a legitimate entity, ensuring that funds are directed to the intended recipient.

Sanction Assessment

PayPal conducts a thorough global Anti-Money Laundering (AML) / Counter-Terrorist Financing (CTF) and Sanction risk assessment in accordance with the guidance provided by the Financial Action Task Force (FATF).

Documentation

We will require proof of identification, beneficial owner details, bank account information, permission for fund transfers, and your company’s trading name to facilitate the onboarding process.

Enhanced Due Diligence

PayPal collect pertinent details during the sign-up process while ensuring a relatively frictionless experience through their Customer Due Diligence program.

Fraudulent and Risky Transactions

PayPal has implemented policies and practices aimed at deterring individuals engaged in money laundering, fraud, and other financial crimes, including terrorist financing, from using our services.

Data Protection

Mantain a data protection regime that is necessary to safeguard personal data from misuse and to maintain individuals’ trust in organizations that manage their data.

We work with industry experts to help us plan, validate and check our server productivity and data security

IT Audit

Our website is tested against OWASPTOP10 list of threats and vulnerabilities. We are audited by CySecure.

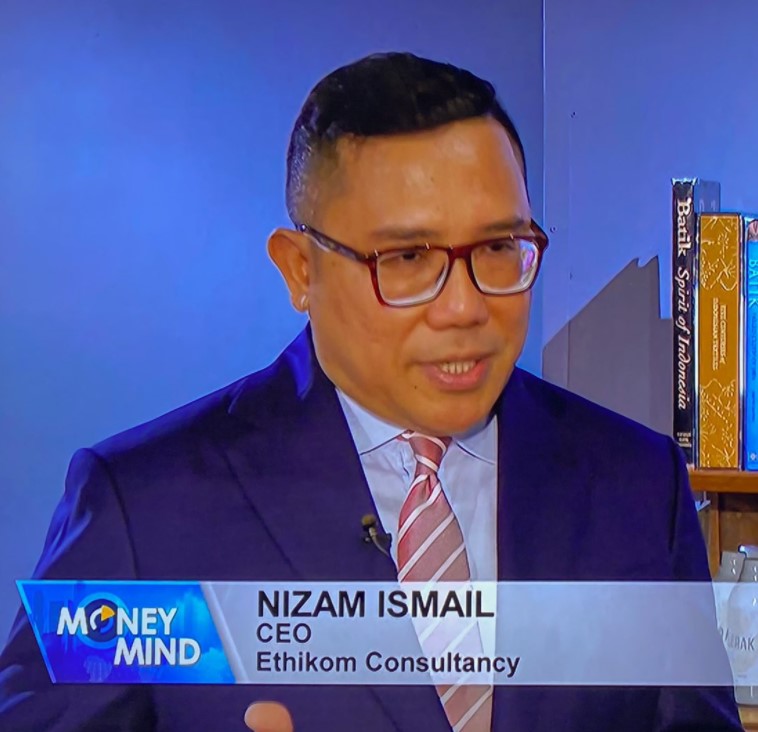

Our Advisors